Sometimes known as "up-front fee fraud", this is a tactic used by some bailiff companies to increase revenue by charging fees for enforcement actions that were never actually carried out.

This practice exploits fee regulations, which allow charges for specific tasks such as attending a property or contacting a debtor. However, in many cases, these fees are charged without the corresponding action ever taking place.

1. Charging a £235 enforcement fee without an actual visit from a bailiff.

2. Sending an uncertificated person to leave a letter and then charging the full fee for a visit that never took place — often called a hit and run tactic.

3. Charging a £110 sale/disposal fee when no sale, removal or storage of goods has taken place.

This conduct is a criminal offence under Section 2 of the Fraud Act 2006 and was confirmed as such by the UK Government in the House of Lords on 20 April 2007.

You can report advance fee fraud to Action Fraud through their official website. Be aware that the police use a set of criteria when deciding whether to investigate. Be sure to present your case clearly and show how it meets those criteria.

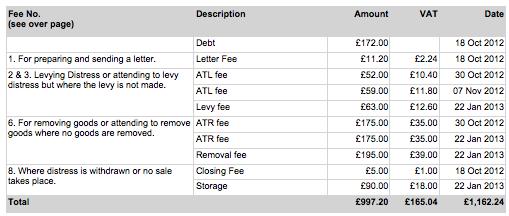

Below is an example of a bailiff charging enforcement fees for work that was never performed. It includes fees not prescribed by the enforcement fee regulations:

If you have received documents from a bailiff that you believe demonstrate advance fee fraud, please email them to: jason@dealingwithbailiffs.co.uk